Application Period is Closed

Stay tuned later this Spring for our 34th Habitat Partner Family Announcement!

About Habitat for HumanityHabitat for Humanity is an international organization with a goal of eliminating poverty housing worldwide. Our mission is to bring individuals, communities, and partner families together to build decent, affordable housing. We achieve this goal by using volunteer labor, donated building materials, and donation and grant funding from the community. There are many Habitat for Humanity affiliates in America with the same goals and mission. However, each Habitat affiliate has slightly different program rules, building regulations, and program services. The Red River Valley Habitat for Humanity currently only builds one house per year and recently started our Habitat for Humanity Helpers Repair Program. You can learn more about that here. We are hoping in the near future to be able to serve more families each year.

|

|

About Our Homeownership Program |

What Habitat for Humanity Doesn't Do |

|

Habitat for Humanity's homeownership program can take up to a year to complete and requires active work from the selected partner family. Upon selection and acceptance into our homeownership program, the partner family will be required to participate in homebuyer education and sweat equity. This includes but is not limited to learning about and navigating the housing market, mortgage and financing information and best practices, housing discrimination and how to recognize and report it, and assisting with the construction of their house. At the completion of the partner family's construction and homebuyer education, the house will be sold to the partner family at a discounted price, no more than 30% of their annual income. Each mortgage is originated with 0% interest and no down payment is required. The mortgage life is 30 years but the partner family is able to pay it off sooner. All partner families are required to live in the house at least 5 years to keep the discounted sale price and are encouraged to stay in the home for at least 30 years to get the maximum financial benefit from our program.

|

The Red River Valley Habitat for Humanity cannot provide rental assistance, rental units, mortgage assistance for loans originating outside of our affiliate, owner occupied or rental unit repairs, or temporary housing. We are able to offer guidance and direction when seeking out resources to help fill these needs but our goals and funding do not allow for projects outside of our homeownership program.

If you need help or assistance with any of these items, please contact Red River Valley Community Action by calling them here. |

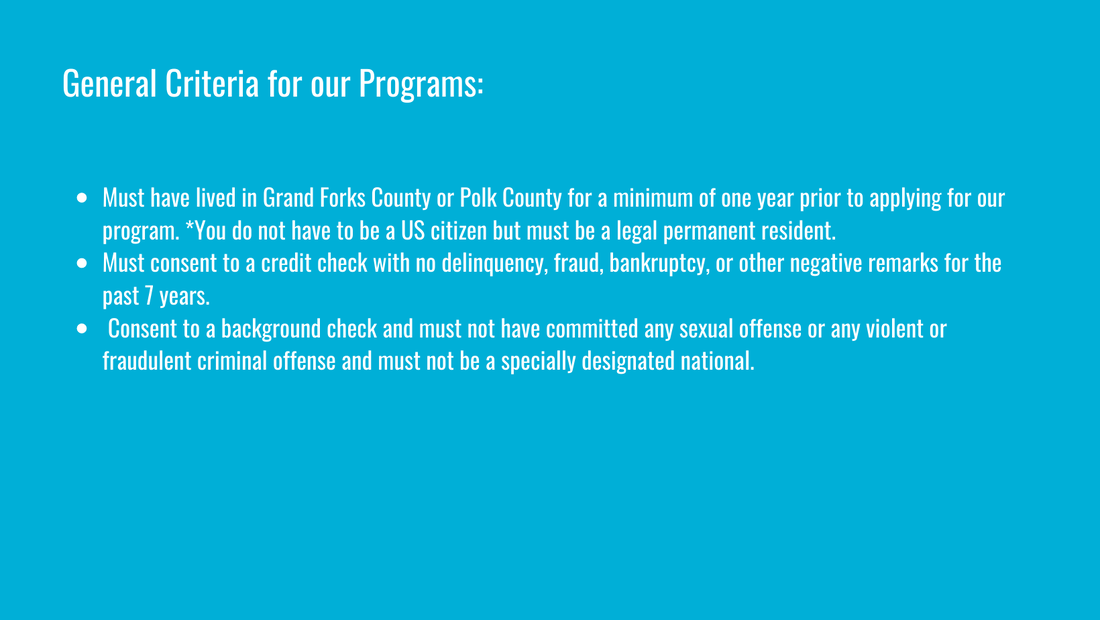

To be eligible to participate in our Homeownership Program, you must meet the criteria outlined below.

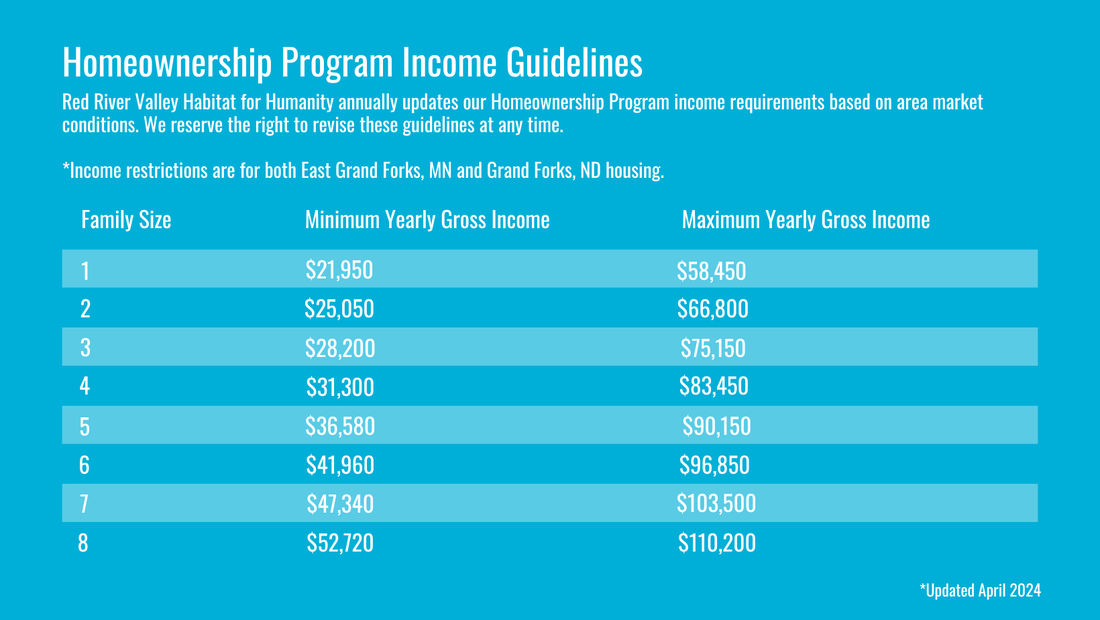

Income Restrictions

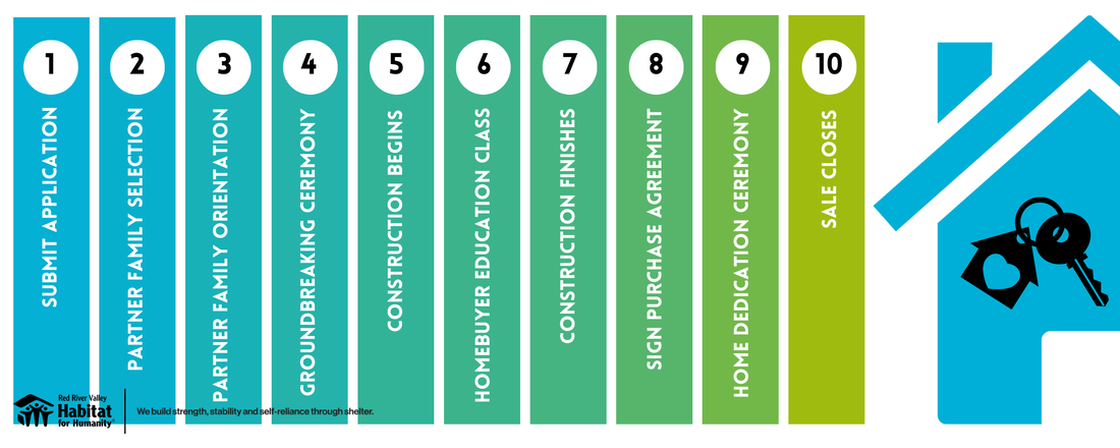

Timeline to Homeownership

1. Submit Application:

Fill out your application as completely as possible- do not leave anything blank! Our team is available to help you fill out the application. If you have any questions please contact us. Other items you may want to include with your application to expedite the process of possible selection are:

2. Partner Family Selection:

3. Partner Family Orientation:

4. Groundbreaking Ceremony:

5. Construction Begins:

6. Partner Family Completes Homebuyer Education Class:

7. Construction Finishes:

8. Sign Purchase Agreement:

9. Home Dedication Ceremony:

10. Sale Closes:

Fill out your application as completely as possible- do not leave anything blank! Our team is available to help you fill out the application. If you have any questions please contact us. Other items you may want to include with your application to expedite the process of possible selection are:

- Tax return

- Paystubs

- Other documentation of income

- Documentation of property ownership if you own property

2. Partner Family Selection:

- There will be two interviews during the selection process.

- Each eligible applicant will interview with 1 or 2 family services committee or staff members.

- After the first round of interviews, a few applications will go onto the second interview round with the full family services committee.

- The committee will then choose an applicant to be our partner family, and the whole board of directors will vote to approve the application

3. Partner Family Orientation:

- The selected partner family will be given information about the program, what their experience will be like in the program, and have the opportunity to ask questions

- Partner families will be required to sign a partnership agreement that includes the requirements to contribute sweat equity and participate in public relations and marketing relating to their home and experience in our program

4. Groundbreaking Ceremony:

- The partner family invites their family, friends, and religious leaders to the vacant lot their house will be built on

- Habitat will thank our community partners contributing to the home build

- Partner families' religious leaders and/or family and friends will provide a dedication or blessing for the project

- The partner family will then dig the first hole in the ground before excavation begins for construction

5. Construction Begins:

- This process will be done largely by Habitat with periodic help from the partner family and their friends and family to fulfill the sweat equity requirement

- This process is NOT like the process seen on HGTV or the process your friends went through to build their home. Because of funding restraints, floorplans, materials, and scheduling decisions will be made by Habitat. Partner families will be able to choose colors for paint, the exterior, flooring, etc., and other decisions as Habitat allows.

6. Partner Family Completes Homebuyer Education Class:

- This class will teach you the financial side of purchasing a home

- This class will teach you how to take care of your home

- You'll learn how to use HOMEOWNERSHIP as a pathway to WEALTH

- Please reach out to your family services advisor at Habitat to answer any questions or clarify things taught in the course

- This course will be taught online and can be completed at your own pace but must be completed by the time construction is completed.

7. Construction Finishes:

- This can take up to 12 months from the time construction begins

- Your home is almost ready for you to move in!

8. Sign Purchase Agreement:

- This meeting will involve a licensed realtor to explain the process of buying a home to you

- We will go over the financial documents of buying the home a with you

- We will go over financial assistance available to you to help with the purchase of the home

- Once all your questions are answered, you will sign a document confirming your intention to purchase the home we've built for you

9. Home Dedication Ceremony:

- This is your chance to show your friends and family the completed home

- This is Habitat's chance (and yours) to thank the community businesses that helped build the home

- The partner family will have the opportunity to again invite their religious leader to provide another blessing on the completed home.

10. Sale Closes:

- About 30 days after the signing of the purchase agreement, the home will officially be ready to sell.

- Habitat representatives and the partner family will meet to sign the sale documents

- Once the documents are signed, the home is yours!

- You may move in anytime after the sale closes

- Mortgage payments begin on the 1st of the month following the sale closing

Ready to Apply?*Failure to include ALL requested information listed on the Homeowner Application when submitted prior to the deadline, will automatically eliminate you from candidacy.

If you meet the above criteria and guidelines, then take the next step to homeownership, by applying to be our next Habitat Partner Family. Our application period is currently CLOSED. If you need an application mailed to you, during our OPEN application period, please call us by clicking the button below, labeled "application needed." If you have any questions regarding the application or need help filling it out, please click the email button below, labeled "I have questions." Join the list of growing Habitat Partner Families today! Read previous homeowner stories here.

|